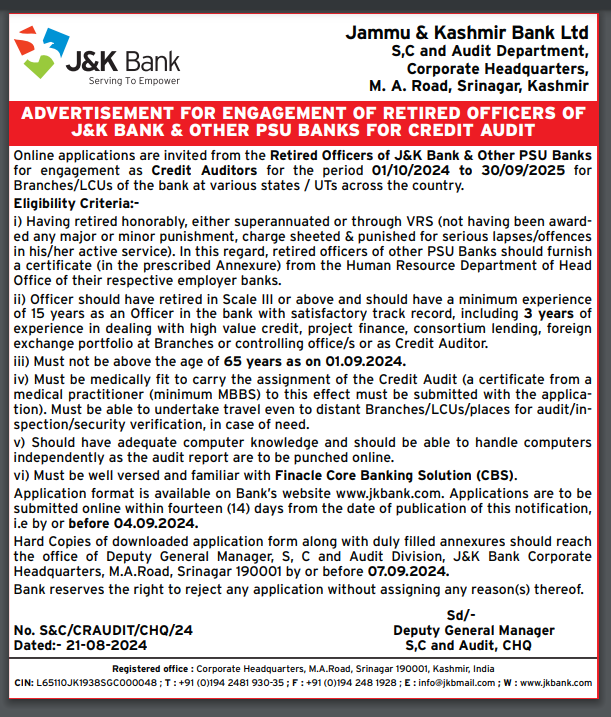

Jammu And Kashmir Bank Recruitment 2024 :- Jammu and Kashmir Bank is inviting retiring candidates from Jammu and Kashmir Bank and other nationalized banks for the post of Credit Auditors/Loan Administrator. Candidates ought to have at slightest 15 a long time of involvement in the pertinent field. As per the official work notice “Jammu and Kashmir Bank Enlistment 2024”, the residency of the candidates is one year i.e. 2024. h. Revoke from 1st of October 2024 to 30th of September 2024.

To apply for Jammu and Kashmir Bank Recruitment 2024, candidates should be medically fit to perform the post of Loan Administrator (relevant medical certificate (minimum MBBS) should be attached with the application). The maximum age for the position to be allotted should not exceed 65 years as on 1st September 2024. Eligible and motivated candidates are required to fill up the application form available on the official website and submit their online application within 14 days from the date of publication. Candidates can also download a printed copy of the application and submit it before the closing date to the following address:

Jammu And Kashmir Bank Recruitment 2024 – Detailed Overview

| Board | Jammu And Kashmir Bank |

| Post | Credit Auditors |

| Form Start | 09 April 2024. |

| Last date | 07 September 2024. |

| Official Website | https://www.jkbank.com/ |

Jammu And Kashmir Bank Recruitment 2024 Job Title:

Retired employees of Jammu Kashmir Bank and other PSU Banks are being considered by Jammu Kashmir Bank for the post of Loan Officer.

Jammu And Kashmir Bank Recruitment 2024 Seniority:

The official Jammu Kashmir Bank vacancies 2024 states that the applicants will be appointed for a term of one year i.e. from 1st of October 2024 to 30th of September 2024.

eligibility Qualfications for Jammu And Kashmir Bank Recruitment 2024:

Candidates applying for Jammu and Kashmir Bank Vacancies 2024 must fulfill the following eligibility criteria:

- Applicants must have been honorably retired through retirement or VRS (must not have received any major or minor punishment during active service even if it is a charge or punishment for serious failure or minor offence). In this regard, retired employees of other PSU banks should submit a certificate (in the prescribed appendix) issued by the HR department of the head office of their respective employer bank.

- Employees should have retired with Grade III or above and have at least 15 years of experience as an employee in the bank and have a satisfactory track record including 3 years of experience in handling large loans, project finance, syndicated loans and foreign exchange portfolios in a branch or administrative office or as a credit officer.

- Candidates must be medically fit to complete the credit assessment task (an appropriate certificate from a General Practitioner (at least MBBS) should be submitted along with the application). Should be able to travel to remote branches/LCUs/locations for Audit/Inspection/Security Clearance as and when required.

- As the exam report has to be entered online, candidates should have adequate computer skills and be able to use computer independently.

- Candidates ought to be commonplace with Finacle Center Keeping money Arrangement (CBS)

Age Limit for Jammu And Kashmir Bank Recruitment 2024:

As specified in the official notice “Jammu and Kashmir Bank Recruitment 2024”, the upper age constrain for the promoted posts ought to not surpass 65 a long time.

Step by step guide to Apply for Jammu and Kashmir Bank Jobs 2024:

Interested and willing candidates should follow the steps below to apply for Jammu and Kashmir Bank Jobs 2024:

- Applicants should complete the online application by visiting the official website.

- Candidates can moreover download the difficult duplicate of the application shape and yield it to the address given below:

Address:

Office of Vice General Manager, S, C and Audit Division, J&K Bank Corporate Office, M.A.Road, Srinagar 190001

- The last date for candidates to submit their online application is 09 April 2024.

- The final date for accommodation of offline application frame is 07 September 2024.

FAQ’S For Jammu and Kashmir Bank Recruitment 2024

Answers to the Frequently Asked Questions (FAQs) regarding Jammu and Kashmir Bank Recruitment 2024 can be found here.

- What jobs are available in Jammu and Kashmir Bank Recruitment 2024?

Jammu and Kashmir Bank Recruitment Loan Officer Vacancy 2024.

- How many years of experience are required for Jammu and Kashmir Bank Vacancy 2024?

Jammu and Kashmir Bank Vacancy 2024 requires at least 3 years of experience.

- What is age limit for Jammu and Kashmir Bank recruitment 2024?

The age limit for Jammu and Kashmir Bank vacancies 2024 should be 65 years or less.

| Official Notification | Click Here |

| Apply Online | Click Here |

| Home | Click Here |

Loan Examiner Policy and other Terms and Conditions.

- While conducting audits, the Credit Examiner shall ensure that any violations of the prescribed systems and procedures, even of a material nature, are reported to the management of J&K Bank in a timely manner so that rectification and corrective action is taken. Recurrence is avoided.

- The Credit Examiner shall not under any circumstances transfer or sub-let any case allotted to him for the purpose of carrying out investigation under contract to any other firm/individual/enterprise.

- Any information regarding the bank’s customers obtained by accessing the bank’s books/records during credit investigation must be kept strictly confidential in accordance with the bank’s confidentiality obligations. It is also important to note that the credit investigator will be liable to the bank for any loss incurred as a result of sharing the information. You will hold the bank harmless in this regard too. The attached confidentiality agreement must be signed by the loan officer on a legal stamp paper worth Rs.100/- and duly returned.

- The Bank reserves the right to terminate this Order at any time without giving any reason and without prior notice.

- If a credit auditor intends to discontinue the audit of an assigned credit account, he is obliged to notify the relevant Deputy Director of the Supervision and Control Department of the dependable division at slightest one month some time recently ceasing the review assignment. In case of default, the Bank is not obliged to pay the fee for the last month audited.

- The Bank reserves the right to withhold/collect the fee if the verification is not carried out as per the Credit Check Policy/Terms & Conditions/Guidelines and any additions/changes notified by the Bank from time to time.

- Loan Officers should not bring any mass storage device like USB stick/flash drive/USB sticks and laptops into the Branch premises and should not use any device which is not required for the work assigned to them.

- Credit Officers should not undertake any other activity/duty on behalf of the Branch/Office without the written consent of S, C, Audit Department at Head Office.

- The Loan Officer shall not be entitled to any compensation/refund/claim other than the prescribed fixed fee of Rs.30,000/- per month as per the statutory guidelines regarding applicable taxes and GST.

- The appointed Credit Officer shall be responsible for his acts and omissions during the term of the agreement.

- In case the credit inspector finds any serious irregularity, he should not wait till the inspection report is completed. The report should be sent immediately when any irregularity has been committed or when it comes to the notice of the auditor. Examples of serious irregularities which require filing of a ‘Flashlight’ are:

- a.Massive violation of RBI regulatory guidelines/bank policies and procedures relating to any area of banking operations.

- b.Falsification/manipulation of vital data/information leading to concealment of the true nature of the branch/soundness of credit assets/material loss of revenue etc.

- c. Apparent deficiencies in the execution of security documents to secure credit facilities. This includes insufficient or no stamping of loan documents or failure to create charges or liens in favour of the bank where such charges or liens may arise in the normal course of the bank’s business;

- d. Monitoring cases of bribery/corruption by branch employees. Instances of actual/attempted fraud/embezzlement or abuse of delegated power/authority to obtain financial advantage at the expense of the bank; improper use of discretionary or delegated powers, undue favouritism or nepotism; or any type of offence prejudicial to the soundness/interests of the branch/bank.

- e. Any other confidential matters pertaining to the business of branch staff/employee.

- f. To ascertain whether there are fictitious accounts through which cheques have been purchased or loaned to conceal fraudulent transactions. These reports should be sent directly to the General Manager/Deputy General Manager (S&C) of the concerned Divisional/Zonal Office.

- The performance of the Credit Inspector will not be judged by a comprehensive audit report but by timely submission of reports and quality of reports. The reports should be comprehensive and cover all aspects very carefully and thoroughly. Its scope and comprehensiveness should be all-encompassing and nothing should be omitted.